I’M penning this dispatch whilst hobnobbing in Davos. While we don’t like to talk politics at LICtalk, we love composing lengthy discourses on economics, which have proven to be correct 50% of the time! We also love hobnobbing.

Anyway, now that the festivities have concluded, I can share that the hottest topics du semaine were inflation, the debt ceiling, and real estate prices in Long Island City. Sure the latter was a very distant third and my numerical ranking system completely subjective, not to mention my universe of subject matter being highly selective. But there was one guy every night at the Postli Club ranting (to himself) so loudly at 3am on the matter, that the subject of LIC real estate even made the local paper. Also fyi, the German word for police is polizei.

Delving in, a headline this week states that “LIC Roommate Rent Jumps 36% In One Year: Data.” While I’ve never heard of the statistic “Roommate Rent,” and a quick look leads me to believe that the “Data” behind it may be spotty and subject to outliers, a more substantive data point mentioned in the article is that Queens rents overall were up 16% year over year. Though large, 16% or anything near it comes as no surprise to those monitoring major financial news headlines regularly.

Yet “36%” headlines turn heads, and also are a good sign of a top in the market. The final surge comes after a big run-up from the depths of the pandemic as people scrambled to get back to NYC from Palookaville and hoovered up rentals. Adding to the recent surge the past year has been the increase in interest rates without the subsequent downdraft in condo prices leading potential home buyers to remain in their rentals. All of this seems to be changing, and local rents may be ready to topple from their lofty perch.

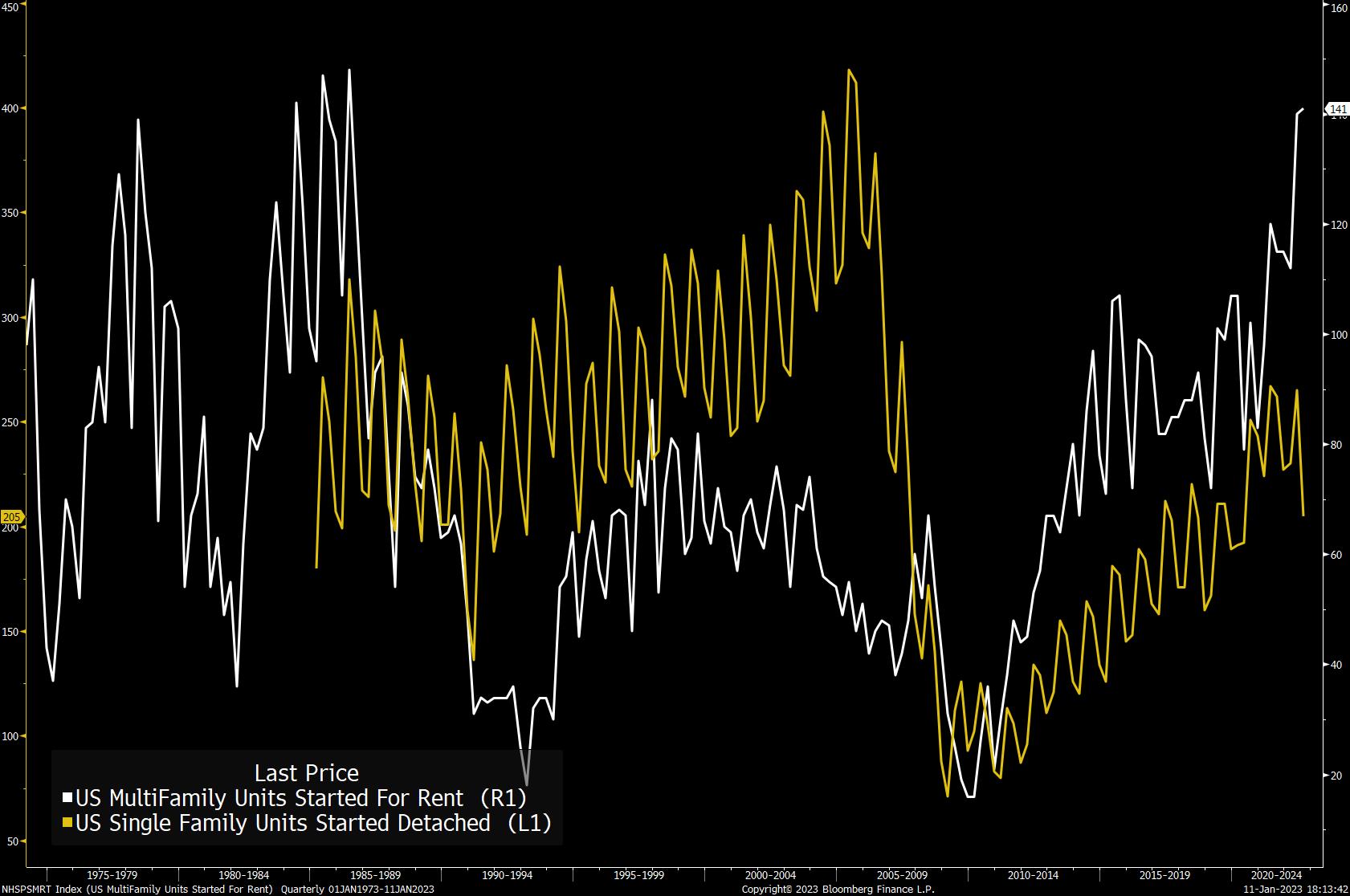

The chart above was generated by Joe Weisenthal at Bloomberg with the comment “Here’s a chart of multi-family housing for rent starts (white line) vs. single family detached starts. It’s the multifamily that’s gone straight up and which easily surpassed its pre-Great Financial Crisis highs. While detached, single family units have never come close to their pre-GFC level of production.”

I really like that chart, it looks just like one I utilized when I bet it all on Sotally Tober in the 8th at Aqueduct back in ’05. So close, SO close. Plus LIC is ground zero for multi-family rental unit growth. Which is exactly why I’m expecting a 25% discount by June on my monthly couch space rental from my eight roommates. Ahh to live on the margins.

LIC Roommate Rent Jumps 36 Percent In One Year: Data – but…

Rental Housing Is Suddenly Headed Toward a Hard Landing – don’t spend all your expected savings in one day, like I did

Mitchell says

Mitchell says

January 24, 2023 at 10:19 amHobnobbing should become an Olympic Sport